LSDFi Ecosystem Accelerator

The unshETH ecosystem is incubating many novel LSDFi products: see below for a brief overview

Validator Dominance Options (VDOs)

Validator Dominance Options (VDOs) are a type of LSDfi primitive that allow dominant LSD holders to write options on their own validator dominance. This allows for the creation of yield for non-dominant LSD holders, while also giving dominant holders a way to earn additional income from their already-established dominance.

Restrictions on VDO writers

Dominant LSD holders can only write VDOs against their own LSDs, no other collateral is accepted.

Short maturities

VDOs have short maturities, typically only a few days or weeks, as LSD holders have no cost of rolling.

Purchase and Pricing

VDOs are purchased for the VDO pool on behalf of non-dominant LSDs by the unshETH DAO, who advances the cost of the option and takes a liquidity preference on the yield if the VDOs for a given maturity pay out. If the option expires worthless, the DAO writes off the cost.

The pricing of VDOs is determined by a pricing surface specifically designed for VDOs, taking into account the validator's dominance, the maturity of the option, and other factors.

Yield for non-dominant holders

Non-dominant LSD holders earn yield through vdMining as well as a portion of the yield earned by the dominant LSD holder if the VDO expires "in-the-money".

Risk and Reward

The riskier the VDO written by the dominant LSD holders, the greater their premium earned, but the higher their potential loss.

*Note: VDOs will be launching after the Shanghai upgrade, as this type of redistribution of yield is not yet possible. A version on the Zhejiang testnet will be released prior to mainnet launch.

Validator Decentralization Mining (vdMining)

vdMining is a token distribution mechanism that rewards users for staking their LSDs in a manner that aligns with the optimal decentralization ratio set by the unshETH community.

The coordinationMultiplier

The coordinationMultiplier is a scaled inverse euclidean distance between the currentRatio and the optimalDecentralizationRatio. It is used to adjust the yield of all users in the vdMining pool. The closer the currentRatio is to the optimalDecentralizationRatio, the higher the coordinationMultiplier, resulting in higher yields for all users in the pool.

It's important to note that all users in the vdMining pool earn with the same coordinationMultiplier. This means that the rewards and penalties are applied collectively to all users in the pool, incentivizing coordination among users in order to increase their collective yield.

The stakeLocked() function is used for depositing LSDs into the vdMining pool. These locked LSDs will be staked until the planned Shanghai upgrade (March 31) after which users will have the option to exit or migrate into the VDOs that will be launching. Users who migrate directly into the VDOs will retain a portion of their user-specific time-based yield multiplier from the vdMining pool.

The coordinationMultiplier formula

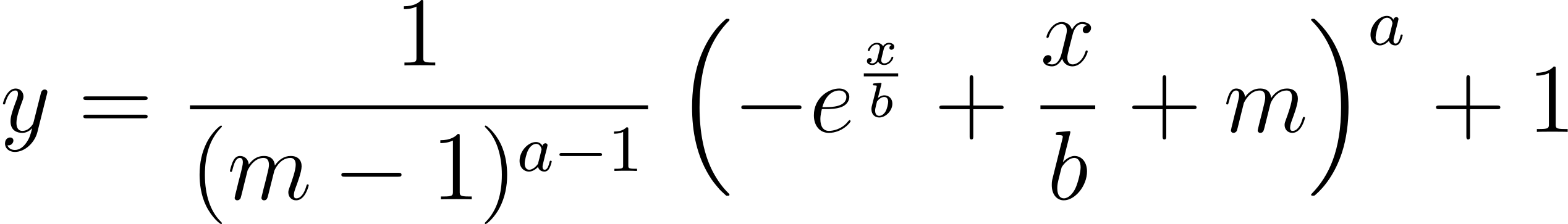

The coordinationMultiplier is calculated using the following formula:

Where:

- d(a, b) is the euclidean distance between a and b

- currentRatio is the current ratio of staked LSDs to total staked LSDs in the vdMining pool

- optimalDecentralizationRatio is the pre-defined optimal ratio of staked LSDs to total staked LSDs, determined by the unshETH community through governance proposals

- min_multiplier is the minimum reward multiplier (e.g. 1x)

- max_multiplier is the maximum reward multiplier (e.g. 10x)

- max_distance is the maximum possible euclidean distance between the currentRatio and the optimalDecentralizationRatio.

It's worth noting that all users collectively earn with the same coordinationMultiplier, as they are rewarded and punished as a group.

LSaaS: Liquid Staking as a Service

unshETH is working to onboard staking validator providers that don't yet have liquid staking tokens to accelerate their entry into the omnichain defi ecosystem. [Coming soon...]

unshETHeum

What's the only thing staked ETH can't be used for? Paying gas fees. What if that could change? [Coming soon...]